KBC has released a report detailing how 2020 brought growth in Irish GDP (Gross Domestic Product) in spite of late slippage, with Ireland likely to outperform the world in GDP growth for the year.

A positive growth rate of 3.4% was recorded across the year, with the weakest quarterly performance coming in Q4, where there was a decline of 5.1%

Multinational Sector

The increase in Irish economic output in 2020 is largely the result of the performance of the multinational sector heavily focussed on pharma and ICT where the pandemic increased demand.

Irish industrial output increased by 15.3% and the output of the ICT sector was up 14.2%, with the multinational sector driving a 6.2% increase in Irish exports, despite difficult export markets for more traditional sectors being observed, with estimates suggesting world trade declined by 5.3% last year.

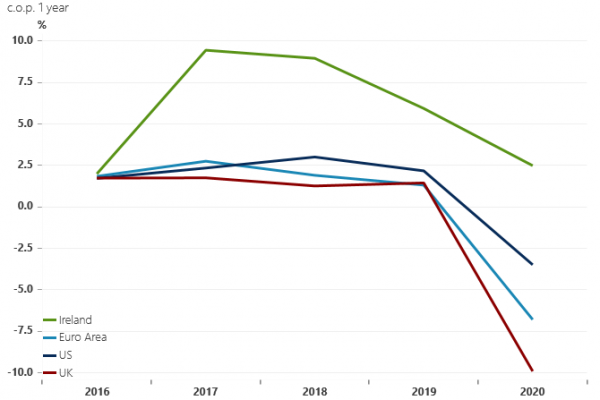

While the multinational sector was the key driver of the positive outturn in 2020, domestic activity also weathered the storm better than feared. Modified domestic demand which measures underlying domestic activity (by excluding large scale multinational capital spending) fell 5.4% last year, defying widespread fears of a decline as much as three times as large and outperforming aggregate economic activity outturns for the Euro area and the UK.

To a significant extent, the much better than feared outturn for domestic activity reflected substantial fiscal support that underpinned positive household income growth and drove a 9.8% increase in public authorities purchases of current goods and services.

Health-related restrictions and uncertainty about the pandemic resulted in a 9% drop in household spending and also a 9.1% fall in building and construction investment. The trend in Irish consumer spending through 2020 closely mirrored the trajectory of the Coronavirus and related restrictions on activity.

By underpinning incomes, fiscal measures supported sentiment and purchasing power and prevented the risk of a self-feeding collapse in confidence and consumer spending, leading to an increase in aggregate savings. While a consumer boom is not predicted in 2021 when social interactions normalise, a strong recovery in consumer spending is expected to take hold.

2021

For 2021, KBC predicts Irish GDP growth of about 5% as domestic spending gradually normalises and strong momentum in multinational activity persists.

Globally, this would represent an exceptionally positive performance but to underpin sustainable solid and, importantly, broadly experienced growth ongoing fiscal support will be required.

While Ireland’s overall positive growth rate in 2020 was underpinned by large multinational businesses, the sectoral breakdown of economic activity for 2020 shows this was accompanied by substantial weakness across a range of areas that may not automatically return to robust health in coming years. In this respect, current conditions reflect, as Minister for Finance, Paschal Donohue, noted in a speech, a classic ‘asymmetric shock’ which can be addressed by appropriate fiscal policy measures.

The strength in Irish GDP in 2020 means that the General government deficit is likely to be 5% of GDP rather than 7.4% initially projected just under a year ago when the pandemic first struck. More significantly, the debt/GDP ratio at end-2020 is likely to be a shade under 60% of GDP compared to the initially estimated 69%.

Importantly, this is not just a matter of stronger GDP translating into a larger denominator. The buoyancy in GDP also meant tax revenues fell €2bn in 2020 rather than the €10bn drop initially envisaged. These developments allow the government to focus on balancing the economy rather than balancing the books.