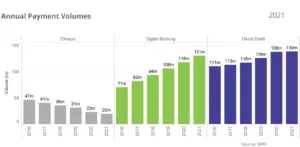

Figures from the latest Banking & Payments Federation Ireland (BPFI) monitor for quarter four of 2021 show a strong increase in online and mobile payments since 2016.

Consumers' use of online and mobile payments has increased by 85% since 2016, with an increase of 10.4% in 2021 alone.

The banking group also reports that total card spending reached a new high in 2021 as consumers and businesses reduced their use of cash and increased their online spend and contactless payments in stores.

Paper-Based Payments Suffer Decline

Total online and mobile payments for 2021 reached a massive 131 million, up from 71 million in 2016.

The reliance on online and mobile methods of pay has led to a sharp decline in paper-based payments in particular, with cheques accounting for 20 million payments, down 14.7% on 2020 and less than half the volume of 2017.

Emphasising the move away from cash was the ATM withdrawal figures, which showed a decline from the 2018 peak of €19.9 billion in 2018 to €12.7 billion in 2021.

Direct debits, which are mainly used for bill payments, grew by 0.7% to 139 million in 2021.

Increase In Contactless Payments

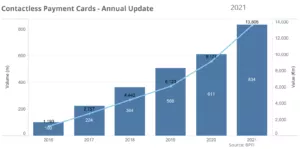

The monitor, which also captures contactless data, shows contactless payments accounted for more than half (52%) of all card payments in 2021, up from 25% in 2017.

In value terms, about 53% of card spending was in stores, down from 61% in 2019, while 36% of in-store spending was contactless, which includes card payments as well mobile wallets such as Apple Pay or Google Pay, up from 17% in 2019.

The report also shows the volume and value of contactless payments rose by 36.5% and 48.3%, respectively, year on year in 2021 to 834 million payments worth €13.6 billion, totalling more than double the value in 2019.

In December 2021, there were 2.99 million contactless payments valued at €53.8 million per day, up from 2.1 million payments valued at €36.5 million a year earlier.

In total, almost €70.7 billion was spent on cards in 2021, up from about €57.2 billion, in 2019, according to Central Bank of Ireland data.

BPFI Comments

Commenting on the latest BPFI report, Brian Hayes, chief executive, BPFI said, "Our latest payments figures which allow us to assess 2021 as a whole, very clearly demonstrate the continued momentum driving the use of digital banking as well as contactless payments and card spend more generally. In just five years we have seen an unprecedented jump of 85% in online and mobile banking payments as consumers continue to adopt to digital channels and move away from paper-based payments. Similarly, as the move away from cash continues and ATM usage falls, consumers are increasingly choosing instead to spend online or to use contactless cards when shopping in store."

"The downward decline of cheques continues, reaching a new low of 20 million payments last year, just 15% of the total volume of digital payments," said Hayes, stressing again the move from paper-based payments.

Looking ahead, Hayes believes that "with the majority of Covid-19 restrictions now removed, we expect these changes in consumer behaviour, that were accelerated during the pandemic, will likely remain and drive a long-lasting shift in the use of digital channels and electronic payments."

© 2022 Checkout – your source for the latest Irish retail news. Article by Conor Farrelly. Click sign up to subscribe to Checkout.