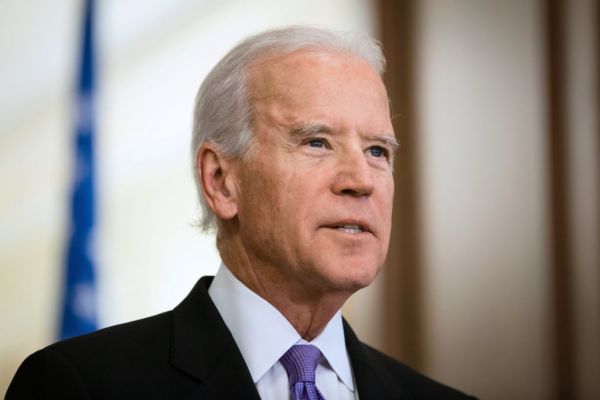

European shares jumped on Monday as a victory for Democrat Joe Biden in the US presidential election raised hopes of better trade ties between Washington and Europe.

The pan-European STOXX 600 was up 1.3% by 0805 GMT, with trade-reliant German shares adding 1.6% as data also showed exports in Europe's largest economy rose more than expected in September.

Japan's Nikkei share average hit a 29-year high, while futures tracking the U.S. S&P 500 index jumped 1.4% as investors bet a Biden presidency and a potentially Republican-held U.S. Senate would lead to fewer industry reforms and more monetary stimulus.

The benchmark STOXX 600 ended Friday with one of its best weeks this year, although surging coronavirus cases across the continent capped gains.

London's FTSE 100 jumped on Monday as investors cheered Joe Biden's US election victory, while also awaiting progress on a Brexit deal with the European Union.

The domestically focussed mid-cap FTSE 250 gained 1.5% after Prime Minister Boris Johnson said on Sunday a Brexit trade deal was "there to be done", suggesting his view that the agreement's broad outline was already "pretty clear" was shared in Brussels.

'A Done Deal'

“Even though Donald Trump has not yet conceded, markets have taken Joe Biden’s election victory to be a done deal which gives another leg up to global equities,” commented Russ Mould, investment director at AJ Bell.

“Stocks had already started to move higher last week on the assumption there would be a divided government. This expectation extends into the new trading week following the latest voting figures which put Biden in first place."

While the threat of legal action by Trump could delay proceedings, Mould added, "investors are pricing in almost zero chance for the incumbent to destabilise affairs. So that means the market is in risk-on mood with equities rising across Asia, Europe and pre-market indicative prices also suggest a good day for US stocks."

China Optimism

Elsewhere, in China, the yuan closed domestic trading at a more than 28-month high against a softer dollar, as investors welcomed Joe Biden's election.

Investors believed that a Biden presidency could mean less uncertainty in foreign and trade policy towards China and expected that he was unlikely to re-open the trade war, which has weighed on the Chinese yuan over the last two years.

Onshore spot yuan opened at 6.5950 per dollar and finished domestic trading session at 6.5728, the strongest such close since June 26, 2018.

Chinese state media also struck an optimistic tone in editorials on Monday reacting to the Democratic candidate's victory, saying relations could be restored to a state of greater predictability and could start with trade.

"We think RMB has priced in the pause of the escalation of U.S.-China trade war," Tommy Xie, head of Greater China research at OCBC Bank in Singapore, said in a note.

"The near-term outlook of the currency may depend on the global risk sentiment as well as broad dollar trajectory."

News by Reuters edited by Donna Ahern, Checkout. Click subscribe to sign up for the Checkout print edition.